Turkish lira hits record low, days after Erdogan's new government appointed

The Turkish lira hit a record low overnight Wednesday, dispelling hope that the currency's instability would end after June's snap election.

It hit a low of 4.9767 lira to the US dollar in overnight trading with Asia after President Recep Tayyip Erdogan said on Wednesday that he expects interest rates to fall, despite persistently high inflation.

Erdogan's aversion to raising interest rates is part of what many describe as an unorthodox economic policy, as higher interest rates are traditionally seen as a way to temper inflation - which had climbed to 12 percent by June - and prevent devaluation.

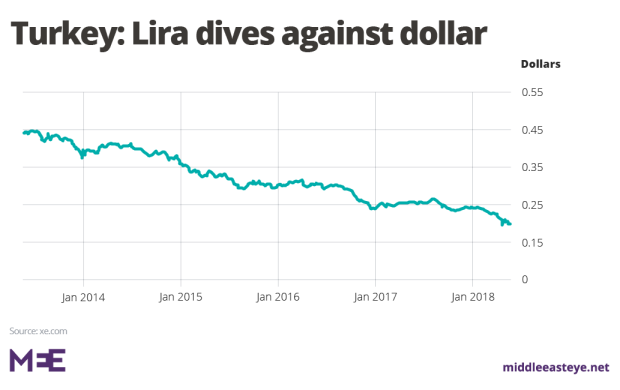

The lira has shed about 22 percent of its value against the US currency so far this year as investors fret over Erdogan's influence on monetary policy and his repeated calls for lower interest rates.

A previous record low, which hit before June's presidential and parliamentary elections, was described as a "foreign plot" by Erdogan and his supporters, who insisted it was a temporary phenomenon designed to influence the vote.

Erdogan's comments have been interpreted by some as a sign of increased direct intervention in economic policy and Turkey's central bank, which sets interest rates, after the election confirmed new executive powers for the president.The mother of all evil

"Erdogan said yesterday interest rates must fall," said a treasury desk trader at one bank. "This has been interpreted as a desire for a Turkish central bank rate cut at a time when additional tightening is expected and inflation has exceeded 15 percent."

The central bank's monetary policy committee, which has raised rates by 500 basis points since April in an effort to put a floor under the currency, will next meet on 24 July.

Erdogan has described high interest rates as "the mother and father of all evil" and has repeatedly expressed a desire for lower borrowing costs to spur economic growth.

Investors believe the credit-fuelled economy is overheating and want decisive interest rate hikes to tame double-digit inflation.

Ratings agency Moody's on Thursday sounded concern about the outlook for the independence of the central bank, given changes this week that make the president solely responsible for appointing members of the bank's monetary policy committee, and shortened the length of the central bank governor's term.

Turkey's new Treasury and Finance Minister Berat Albayrak, who is Erdogan's son-in-law, said on Thursday that tackling inflation would be a priority for the government.

He also said suggestions that the central bank was not independent were "unacceptable", reported Turkish newspaper Daily Sabah.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.