Israel and Lebanon's border dispute could give the UAE a Mediterranean foothold

With the United Arab Emirates now boasting relations with Israel as well as Lebanon, the UAE's oil companies could benefit from this new status and drill for gas in the waters disputed between the two enemies.

However, competition will be fierce for a slice of the drilling rights, and Lebanon's enmity towards Israel makes agreement for sharing potential proceeds a dim prospect.

Indirect talks between Israel and Lebanon, held at a base of the UN peacekeeping force, Unifil, and mediated by the United States, were started in October in a bid to settle a dispute over the neighbours' maritime border.

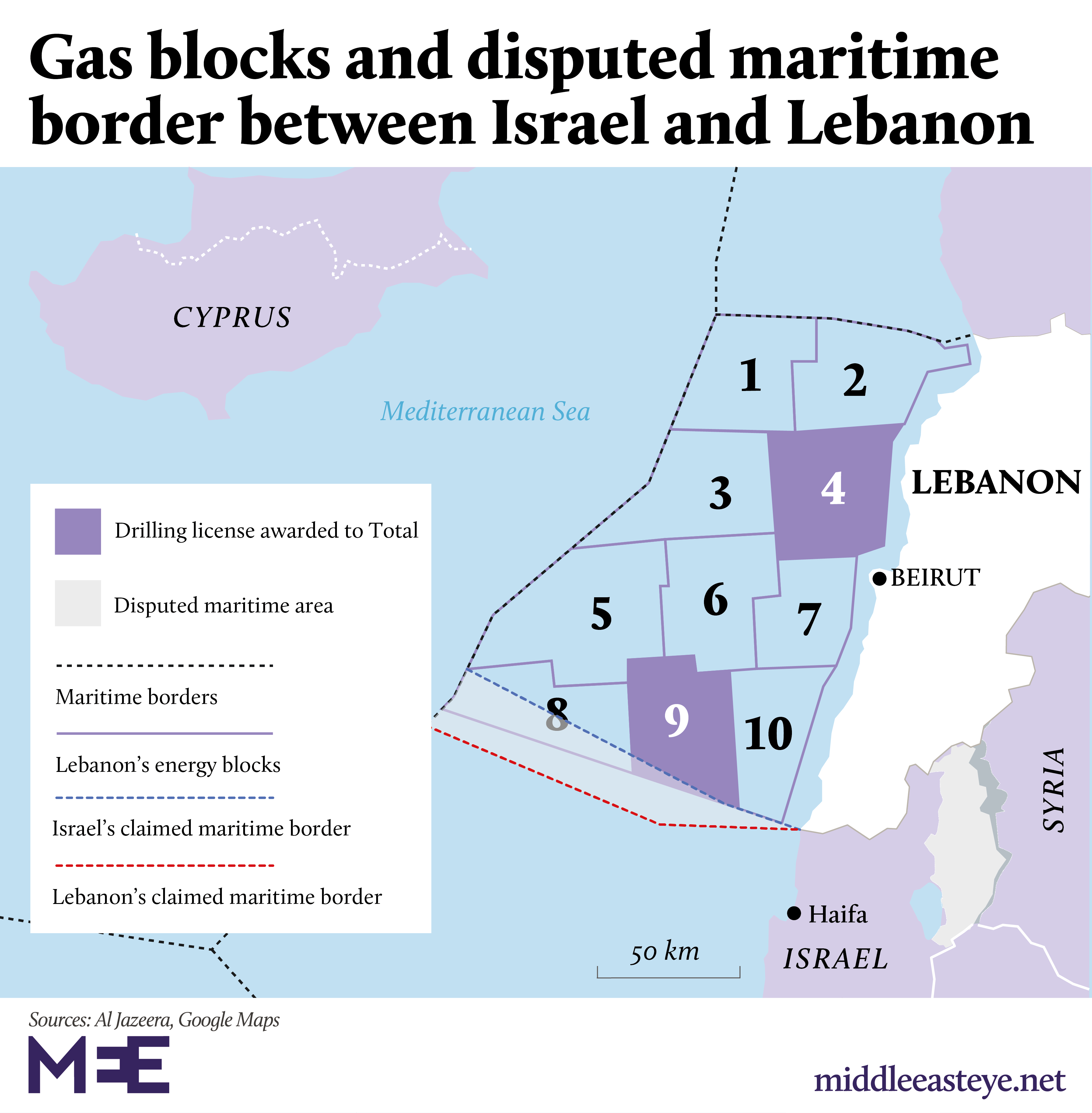

The area of the Mediterranean in question stretches over two blocs of territory divvied up by Beirut to present for gas exploration tenders. It is an 860 square kilometre area of sea, according to a map registered with the United Nations in 2011.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

As with all matters concerning Lebanon and Israel, which have been enemy states since 1948, the border is highly contentious. The possibility that natural gas reserves lie beneath the sea raises the stakes even further, particularly for Lebanon, which is suffering under a frightening economic crisis.

Amos Hochstein, a former special envoy and coordinator for international energy affairs at the US State Department during the administration of then-president Barack Obama, tweeted in December that the Abu Dhabi National Oil Company (ADNOC Group) "could now become a significant part of the solution to the Lebanon-Israel maritime dispute".

Amos said that ADNOC Group could take "an operating stake in Lebanese southern blocks as well as the northern Israeli blocks. Easier to unitise and deconflict."

Mohamad Obeid, a Lebanese figure with inside knowledge of Lebanese-Israeli indirect talks, told Middle East Eye that Hochstein's proposal "was not first of its kind".

'One of Satterfield's proposals was to set up a mutual trust fund between Israel and Lebanon under UN supervision'

- Mohamad Obeid

Obeid said David Satterfield, the former US deputy assistant secretary of state, raised such a proposal in 2019.

"One of [Satterfield's] proposals was to set up a mutual trust fund between Israel and Lebanon under UN supervision, stating that if there was a supposed agreement over borders and the gas fields' distribution and profits percentage, these profits will be allocated to the respective parties based on the supposed percentage," Obeid told MEE.

However, such a proposal aiming to establish indirect economic cooperation with Israel was rejected by the Lebanese side, according to Obeid, and Satterfield had to hand the maritime border file to his replacement, David Schenker, in September 2019.

Obeid added that any proposal like the one suggested by Hochstein "will lead automatically to the rejection and the withdrawal of the Lebanese negotiation team" because it would lead to direct financial cooperation with Israel before even settling the border.

However, the indirect Lebanese-Israeli talks quickly reached deadlock after they began.

Israel-UAE deal

Since Satterfield's proposal in 2019, political alliances in the Middle East have shifted, with the United Arab Emirates, along with Bahrain, signing a normalisation deal with Israel in Washington on 15 September.

Since then, the UAE has taken several steps to boost its presence in the eastern Mediterranean, now a hotspot of geopolitical competition over possible gas reserves, drawing in countries such as Cyprus, Egypt, Turkey and Greece.

The UAE, OPEC's third-largest oil producer, has signed trade and shipping deals with Israel, and Dubai's DP company has placed a bid to buy Haifa Port, which is being developed by a Chinese company. Israeli pipeline company EAPC in October signed a deal to transport UAE crude oil to Europe via a pipeline that connects the Red Sea city of Eilat and the Mediterranean port of Ashkelon.

Meanwhile, in December, the UAE joined the Gas Mediterranean Forum (EMGF) as an observer, and Emirati and Israeli energy officials and representatives of ADNOC Group have met to discuss bilateral cooperation in petroleum and natural gas.

Mona Sukkarieh, a political risk consultant and co-founder of Middle East Strategic Perspectives, told MEE that EMGF is a newly founded organisation that will provide a platform for discussions between countries and various stakeholders, but it still needs to prove itself.

"There are areas for energy cooperation in the region, and in this regard, clearly, the UAE can bring added value if it identifies opportunities," Sukkarieh said.

She added that early gas discoveries in the eastern Mediterranean triggered a wave of interest in delimiting maritime boundaries to pave the way for offshore exploration.

"Offshore resources brought the attention back to this 'rediscovered space' and created new dynamics, but this is not a dispute over resources, but disputes over sovereignty, borders and influence," she added.

Lebanon, Sukkarieh said, does not have confirmed oil or gas reserves, but seismic studies point to an interesting energy potential.

"Total drilled Lebanon's first offshore well in 2020 with disappointing results. But offshore exploration is a long process, with a lot of challenges and uncertainties. Even a disappointing well brings along invaluable data. The more data we have, the better our prospects for discoveries further down the road," Sukkarieh said.

Block 4 and Block 9

Lebanon handed the first two contracts for offshore exploration to French energy giant Total, which said it came up dry in Block 4. In June, Total was reportedly preparing to drill in Block 9, part of which lies in the disputed area.

The operation has been postponed and delayed several times due to maritime border talks. In June, Wissam Chbat, a board member at the Lebanese Petroleum Administration, said in an interview that Total is to complete drilling by May 2021, but the company has not started yet.

A Lebanese official who is part of the team involved in the indirect talks told MEE he did not exclude the possibility of the ADNOC Group's involvement in offshore exploration being discussed in the "diplomatic corridors, but the Lebanese delegation has not been approached with such a proposal".

However, the official added, such a deal seems out of the question while negotiations between Lebanon and Israel are stalemated.

"Such an initiative is part of an ongoing effort to force a solution that creates a context of indirect cooperation with the Israeli side. It is an old and ongoing attempt by the Israelis to set a course of normalisation with the Lebanese side, which does not accept it," said the source, speaking on condition of anonymity.

'It is an old and ongoing attempt by the Israelis to set a course of normalisation with the Lebanese side, which does not accept it'

- Lebanese official

Drilling and developing deepwater gas fields is a complex and expensive operation, according to Sukkarieh.

"Over the past decade, we have seen how challenging it is to exploit deepwater gas fields in the region. Small domestic markets, lack of adequate export infrastructure and geopolitical tensions make it even harder," she said, pushing countries in the region to consider cooperation in order to create synergies and lower costs.

Despite the expertise the UAE could offer, Laury Haytayan, the director of the New York-headquartered Natural Resource Governance Institute, told MEE that Emirati interest in the area should not be overblown and Hotchstein's proposal is not "an official initiative".

Haytayan said that Emirati officials view Lebanon as an "Iranian base," thus the "UAE will not be interested in playing a positive role in Lebanon that might be profitable for the Lebanese state under the patronage of Iran".

Haytayan, however, said that, before attempting to clear the way for offshore gas exploration, an agreement between Israel and Lebanon over borders should be signed first, which will be "the main starting point for any future discussion regarding the distribution of gas revenues".

MEE has contacted ADNOC Group for comment. US State Department officials declined to comment on the record.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.