Suez Canal: Dislodging the Ever Given could take 'weeks', says salvage company

Shipping experts believe it could take weeks to free a gigantic container vessel that was knocked off course and became wedged across the Suez Canal, one of the world's busiest waterways.

On Thursday, the Suez Canal Authority temporarily suspended navigation in the international maritime passage as tug boats and diggers struggled to refloat the 224,000-ton vessel.

Salvage teams from the Netherlands and Japan have been hired to devise a plan to refloat the Ever Given, the company leasing the vessel said on Thursday.

'The losses will become far bigger if the crisis drags on for days, let alone for weeks,'

- Rashad Abdo, Egyptian Forum for Economic and Strategic Studies

Suez Canal Authority spokesman George Safwat told Middle East Eye that his colleagues were doing their best to refloat the Panama-flagged ship.

"Our tractors are now removing sand from around the vessel so that we can edge it away from the course," Safwat said on Thursday. "We hope we can end the crisis very soon."

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

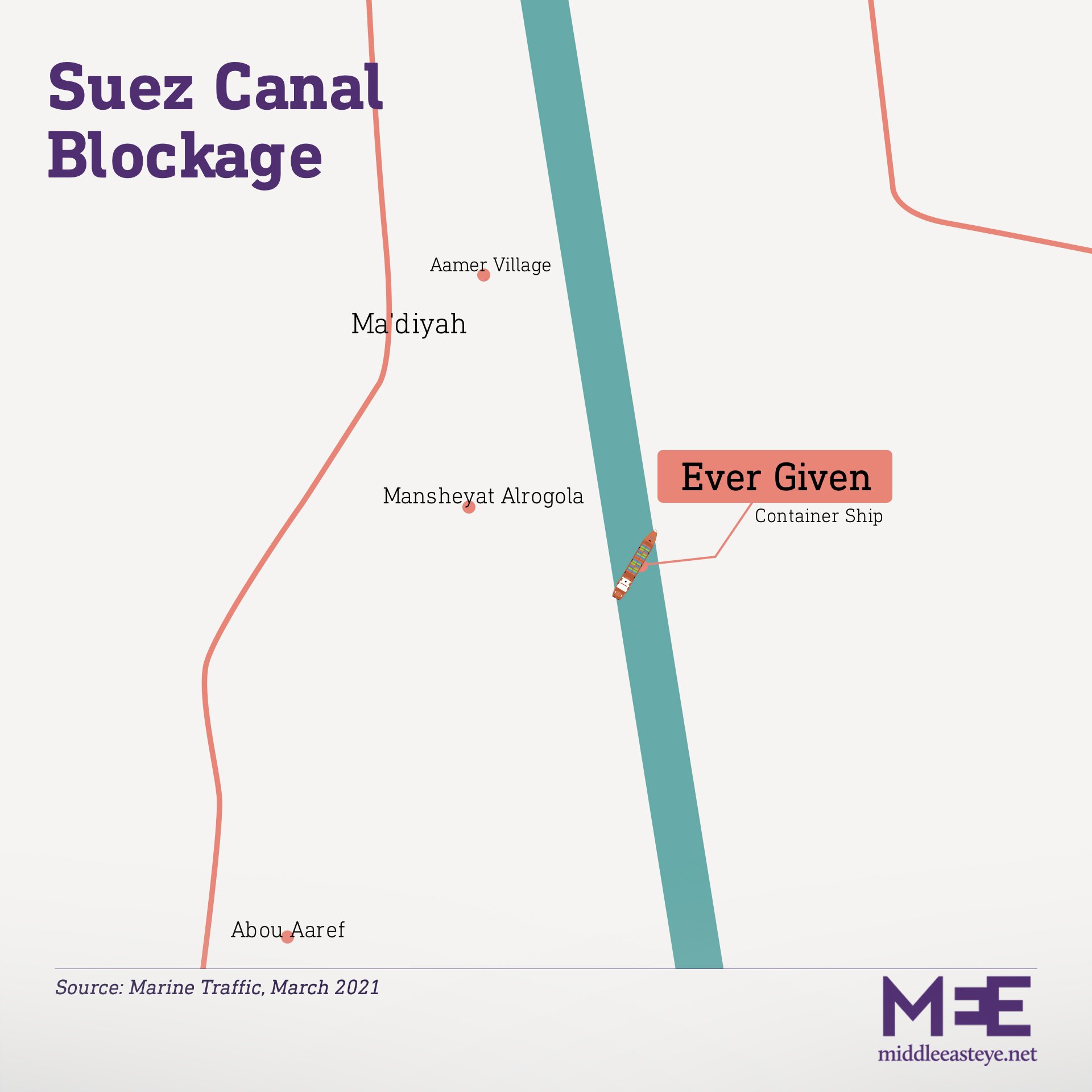

The Ever Given container vessel, owned by the Taiwanese transport company Evergreen Marine, ran aground at around 18:30 GMT on Tuesday as it passed through the canal, having sailed from China en route to Rotterdam.

The 400-metre-long and 59-metre-wide ship was carrying around 20,000 containers when it became wedged across the canal, creating a gridlock unseen for many years in the waterway, the shortest maritime link between the Red Sea and the Mediterranean, through which almost 12 percent of the world's trade passes.

Suspending traffic in the canal came after an initial forecast by its authority that putting Ever Given to sea would not take a long time.

"However, we have decided to suspend navigation through the canal until the flotation of the vessel is complete," authority chairman Admiral Osama Rabie said in a statement.

Knock-on effects

The Suez Canal Authority (SCA) has utilised eight tug boats at its disposal, along with several diggers, in its bid to clear the waterway, amid expectations that it would take the authority and its engineers some time to get the ship back on its way.

Alarm is increasing in the international maritime industry, and in the markets.

International oil prices have already been affected, with the failure of oil tankers to pass through the canal causing a backlog.

There is uncertainty over the prospect of ending the crisis quickly, amid expectations that it could take days until engineers are able to refloat Ever Given.

The Dutch dredging and heavylift company, Royal Boskalis Westminster NV, said the removal of the container vessel from the waterway would take weeks.

'Weather conditions are contributing to the difficulty of the situation'

- Mohamed Mitwali, maritime transport specialist

The company's CEO Peter Berdowski said he believed it was too early to tell how long the job might take.

"We can't exclude it might take weeks depending on the situation," said Berdowski, whose sister company SMIT salvage is now working to free the ship, Reuters reported.

Such an outcome would be a catastrophic scenario for Egypt, for world trade and for the Suez Canal.

Losses to the canal, to international maritime lines and to Egypt are now in the hundreds of millions of dollars.

"The losses will become far bigger if the crisis drags on for days, let alone for weeks," Rashad Abdo, the director of the Egyptian Forum for Economic Studies, a local think-tank, told MEE.

He said an extended crisis could partially threaten energy supplies around the world and force international maritime lines to seek alternative routes, far costlier than the Suez Canal.

International rescue effort

A team from Boskalis has already travelled to Egypt to help in efforts to refloat the ship.

More teams are reportedly considering the best way of offering a helping hand, amid expectations that specialised international companies will fly their experts to the canal to end the crisis.

The crisis takes place at an unfortunate time for Egypt and for international markets.

Egypt has been trying to compensate for some of the losses it sustained because of the Covid-19 pandemic, an effort in which the canal, which brings the populous country billions of dollars in revenues every year, takes centre stage.

International markets are also gasping for relief from the economic slowdown induced by the pandemic.

There is alarm inside Egyptian institutions from the effect of the crisis on the national economy.

The parliamentary committee on transport says it is following the crisis with the Suez Canal Authority around the clock to assess efforts and bring navigation in the canal back to normal.

"The authority is working hard to solve the problem and we are following the work being done in this regard very closely," committee member Mahmud al-Dabaa told MEE. "We have confidence that the authority engineers are doing the right thing to bring the canal back to normal soon."

Desperate for solutions

Specialists are mulling different solutions to pull Ever Given loose.

The solutions, they say, include the drainage of water and oil from the ship to rid it of some of its weight - or to remove some of the 20,000 containers on board - although that would take considerable time.

"Weather conditions are contributing to the difficulty of the situation," maritime transport specialist Mohamed Mitwali told MEE. "Adding to the difficulty is that any of these solutions will take time to implement."

The SCA has apparently opted for dredging the part of the canal where the ship is now stuck, using its own tractors and diggers.

"We are considering all solutions to end the crisis," Safwat, of the Suez Canal Authority, said. "I am sure we will succeed soon."

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.