Saudi Arabia considers accepting yuan instead of dollars for oil sales, report says

Saudi and Chinese officials are in talks to price some of the Gulf nation's oil sales in yuan rather than dollars, the Wall Street Journal reported Tuesday, citing people familiar with the matter.

The two countries have been in discussions about yuan-priced oil contracts since at least 2016, but they have advanced recently on the back of growing Saudi concerns over Washington's commitment to the kingdom's security.

The Biden administration is in the final stages of negotiations with Iran aimed at reviving the 2015 nuclear deal. Riyadh opposed the original agreement and backed the Trump administration's decision to withdraw from the accord in 2018, which saw Washington impose debilitating sanctions on Tehran.

Like other countries in the region, the Saudis have perceived the chaotic US withdrawal from Afghanistan and Washington's renewed focus on great-power rivalry with China and Russia as indications of a wider US disengagement from the region.

While many of these issues have been festering for years, such as when the Trump administration refused to respond to a massive 2019 attack on Saudi oil facilities, ties between the two allies have hit new lows under US President Joe Biden.

On the campaign trail, Biden pledged to make the oil-rich kingdom the "pariah that they are" for the murder of Middle East Eye journalist Jamal Khashoggi in 2018.

Shortly after taking office, Biden ruled out dealing directly with the country's de facto ruler, Crown Prince Mohammed bin Salman, who US intelligence authorities say ordered Khashoggi's killing.

Last month, as the administration scrambled to get Gulf states to increase oil production, the crown prince reportedly rejected the offer of a phone call from the US president, the Journal reported.

The Saudis have also been angered over what they see as the US's lack of support for their war against Iran-aligned Houthis in Yemen.

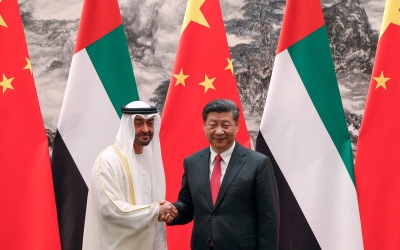

Saudi-China ties

While many analysts doubt China's appetite to replace the US as security guarantor for the region, economic ties between Beijing and Riyadh have grown.

China is the kingdom's largest trade partner, mainly because it purchases 25 percent of all of Riyadh's oil exports.

Saudi Arabia is also a central pillar of China's Belt and Road infrastructure initiative and ranks in the top three countries globally for Chinese construction projects, according to the China Global Investment Tracker, run by the American Enterprise Institute.

A move to conduct oil transactions with China in yuan would mark a profound shift for the oil market, where 80 percent of sales are conducted in dollars. All of Saudi Arabia's sales are exclusively done in dollars.

A departure from dollars in oil contracts would also aid China’s efforts to convince more countries and international investors to transact in its currency.

The US dollar has dominated the global financial system as a medium of exchange since the Second World War.

Besides allowing the US to print treasury bills and sell its debt globally, the supremacy of the dollar is a central reason why the US is able to impose powerful sanctions on countries such as Russia and Iran, cutting them out of international financial transactions.

Some analysts expect efforts to replace the dollar to gain more traction, especially amongst the US’s foes, following the unprecedented sanctions Washington and its allies imposed on Russia for its invasion of Ukraine.

As part of those efforts, Russia has been blocked from selling foreign currencies in its reserves stockpile.

According to the journal, the Saudis still plan to conduct most oil transactions in dollars.

Saudi officials who favour the shift to the yuan have argued the kingdom could use part of new currency revenues to pay Chinese contractors involved in mega projects within the kingdom domestically, which would reduce the risks associated with the capital controls Beijing imposes on its currency.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.