Why Egypt is not too big to fail

A popular saying among western think tanks and policymakers, especially in Washington, is that “Egypt is too big to fail”. But this mythical saying reflects wishful thinking more than it reflects the reality in Egypt today.

Egypt is going through a severe economic crisis amid a high level of external debt, which has soared past $145bn, although there are suspicions that the real figure is even higher. At the same time, internal public debt has ballooned to $5tn Egyptian pounds ($269bn), roughly equivalent to the country’s GDP.

The economy is based on a closed military mentality that seeks to dominate and control everything, at any cost

Egypt is simultaneously witnessing a decline in foreign investment and a drainage of hot capital amid dwindling competitive opportunities in the country, as a result of military dominance over various economic sectors and the US Federal Reserve’s recent decision to hike interest rates. In March, Egypt devalued its pound by 14 percent, and earlier this month, the country’s central bank also raised interest rates, with further economic turmoil expected in the weeks ahead.

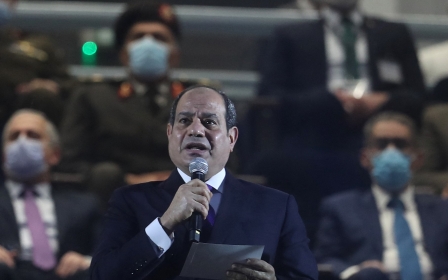

There are several reasons for Egypt’s current economic crisis, the first and most important of which is the catastrophic failure of the economic policies pursued by General Abdel Fattah el-Sisi’s regime from 2014 until today. These include an excessive reliance on borrowing to finance projects and economic plans, alongside an absence of spending priorities.

Rather than directing such funds towards programmes that would serve average citizens, such as healthcare, transport and education, the regime has instead financed major projects that serve only a wealthy elite. The most prominent is the New Administrative Capital project, with a price tag exceeding $50bn, which has yet to be completed amid funding shortfalls. Egypt also recently signed a contract for a $23bn high-speed train linking the country’s eastern and northern coasts.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Severe repercussions

At the same time, construction and housing projects appear to be suffering from a severe shortage of demand as the economic fallout hits average citizens, with more than 12 million housing units in Egypt reportedly vacant. Yet the government has maintained its focus on projects, such as expanding the Suez Canal at a cost of more than 60 billion Egyptian pounds, without achieving any significant return on investment.

The situation has spiralled further in the wake of the Russia-Ukraine war, which has wreaked havoc on global food and fuel prices. Egypt relies heavily on imports, particularly wheat, as the world’s largest importer of grain. Ukraine and Russia are major producers and exporters of wheat, and rising food prices triggered by the war could cause mass deaths globally, Egypt’s finance minister recently warned.

The war has also had severe repercussions on the tourism sector in Egypt, curbing the usual influx of Russian and Ukrainian tourists to the country. Egypt traditionally rakes in billions annually from tourism, but those revenues already took a significant hit during the Covid-19 pandemic, and the war is adding a new burden to the Egyptian economy - not only because of declining tourism revenues, but also due to the loss of associated jobs in this sector.

At the same time, the Sisi regime has spent billions of dollars on weapons over the past eight years, putting additional pressure on the Egyptian treasury. In 2020, Egypt was among the world’s top five arms importers, along with Saudi Arabia, India, Australia and China. The regime has concluded dozens of military deals with countries such as Russia, France, Italy, Germany and the US, buying political clout at the expense of the Egyptian public.

An important question

Egypt’s current financial crisis raises many questions about its repercussions not only on the regime’s survival, but also on the cohesion of the state and society, and the extent to which Egypt is becoming a failed state on the brink of bankruptcy. Such a failure would also mean the state and its institutions could not meet the basic needs of Egyptian citizens in terms of food, drink and housing.

Such a scenario cannot be ruled out in light of the continuation of the same policies and leadership that Egypt has today - a situation in which no one in the highest echelons of powers is monitored or held accountable.

We cannot separate the political and economic aspects of the crisis gripping Egypt today. The economy is based on a closed military mentality that seeks to dominate and control everything, at any cost. Sisi has expressed his contempt for economic feasibility studies, convinced that he understands everything and can control everything, from the economy, to the political sphere, to the arts.

The latter was evident in his supervision of the television series The Choice 3, broadcasted during Ramadan, which comprised political propaganda aimed at improving the image of the Sisi regime and continuing to demonise its opponents in the Muslim Brotherhood.

It is unimaginable that Egypt will succeed in overcoming the current economic and social crisis without changing the structure of the regime, which begins with changing Sisi himself. The important question remains: how can that happen?

The views expressed in this article belong to the author and do not necessarily reflect the editorial policy of Middle East Eye.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.