Egypt: How Sisi is running a pyramid scheme

In a powerful analysis released by the Project On Middle East Democracy earlier this month, analyst Robert Springborg described Egypt as a “beggar state” that behaves as though it were an “oil-rich rentier state like Saudi Arabia or a successful mercantile one like China, though Egypt is neither”. He further warns of striking similarities with pre-crisis Lebanon.

Although I have also warned about the imminent risk of financial collapse in the media, as well as in letters and meetings with western political leaders, I would not wish on my worst enemy to have to read Springborg’s words about their own country. It’s like a Don’t Look Up scenario, except instead of ignoring a threatening comet, it is a country of 102 million people about to be hit by one.

These appalling lending and spending habits are further enabled by the actions of international lenders

Egypt’s national debt has quadrupled to $370bn since 2010, but key structural issues, such as the devastated public education sector and low-quality public health system have yet to be addressed. Egypt’s labour force participation rate has decreased to 42 percent, far below the low- and middle-income country average of 58 percent.

This is not surprising, given how the private sector has been suffocating under the constraints and opacity imposed by the military, which owns most of the economy and is forcefully purchasing privately owned enterprises.

Yet, instead of making the most of this windfall to transform Egypt’s economy into a value-creating engine that draws foreign investment, Sisi’s regime has wasted billions on mega-projects mired in corruption, with no clear economic or even political outcome in terms of development.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Creative accounting

The country’s $58bn new administrative capital will obviously not benefit most Egyptians, and Cairo will remain as chaotic as ever. The construction of new presidential palaces and residences has drawn comparisons to Mussolini’s “wow effect” strategy. Meanwhile, some 30 million Egyptians live on less than $3.20 a day.

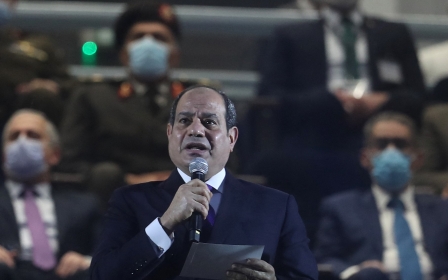

I never thought one of our greatest cultural heritage sites could be used to negatively describe the Egyptian economy, but the truth is that President Abdel Fattah el-Sisi is running Egypt like a pyramid scheme. He attracts private foreign investors with the world’s highest real interest rate; money from new investors then pays for older investors’ debt.

Egypt’s debt is around 90 percent of the country’s GDP, and yet, thanks to the regime’s creative accounting, this only covers 54 percent of the total national debt. More than a third of the government’s revenue is directly swallowed by interest payments. This is obviously unsustainable.

These appalling lending and spending habits are further enabled by the actions of international lenders. Since 2016, the International Monetary Fund (IMF) has loaned $20bn to Sisi’s regime. It seems that nothing can change the IMF’s determination to support Sisi’s so-called reform plan; the interest repayment burden, corruption, human rights violations and senseless investments have clearly not factored into its calculations.

Senseless spending

The IMF, US, UK, France, Germany - and the list goes on - are all guilty of indulging a dictator’s senseless spending. In truth, it is lucrative, given all the money made on Egyptians’ backs through arms deals, as illustrated by the recent $2.5bn weapons deal with the US, announced on the anniversary of the Egyptian uprising. But this is short-sighted, as such policies are actually helping Sisi lead my country to collapse.

Many opponents and academics have tried to raise the alarm about this threat, with no success. Sooner or later, this Ponzi scheme will come to a crashing end. As Springborg brilliantly detailed, creative accounting, dependence on volatile capital inflows and understated public debt, among other factors, are all reminiscent of the Lebanese tragedy. What will happen in Egypt, which has a population 15 times as large?

When meeting with western political leaders, Egyptian opposition leaders are often told that Sisi plays a crucial role in the control of migration. Although this is a dubious argument, I find it astonishing that the same political leaders are reinforcing the conditions for a financial catastrophe with human consequences of an unimaginable scale.

Who will take responsibility before it is too late? This is a call to action. Every single penny injected into Egypt must be channeled into reforming a deeply dysfunctional system.

Reforms should not be about taxing more and subsidising less, but about tackling the military’s grip on much of the economy, and giving fresh air to the private sector. At the core of this issue is the violation of the rule of law, which is why every penny for Egypt must be conditioned on political and human rights advancements.

The views expressed in this article belong to the author and do not necessarily reflect the editorial policy of Middle East Eye.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.