Nowruz: Iranians go without as inflation gets worse

In the heart of Tehran, a butcher is talking about the impact Iran’s runaway inflation is having on his business.

“The number of people buying meat has dropped to less than a third of what it was in previous years,” he says at his shop in Hafte Tir Square. “Everyone just asks what the prices are or wants some bad quality meat.”

With the Iranian rial’s value plummeting against the US dollar on a daily basis, rampant inflation and widespread unemployment, the purchasing power of Iranians has significantly decreased, causing widespread public dissatisfaction.

'Unfortunately, the exorbitant prices have rendered many items unattainable for some of our customers'

- Tehran suit seller

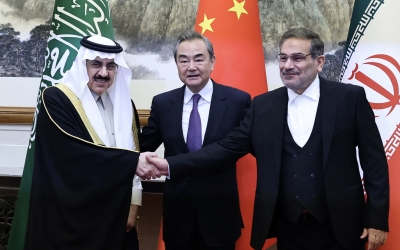

On 27 February, the rial hit a record low of about 583,500 against the US dollar, though it rallied somewhat following the restoration of diplomatic relations with Saudi Arabia to the point where it was trading at an average of 458,500 against the dollar on Sunday.

Iranians have struggled with economic hardship for years, and a recent report from the labour ministry has shed light on their predicament. In 2021, per capita calorie consumption among Iranians was approximately 2200 calories, a decrease of 8.3 percent from 2017 and 18.5 percent from 2011.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

The Statistical Centre of Iran’s latest figures reveal that inflation rates reached 53.4 percent in February, a 2.1 percent increase from the previous month.

Food items, particularly vegetables and meat, witnessed the most significant price increases. Further, the Central Bank's report indicates a 43 percent rise in inflation rates in February compared to the previous year, with a 21.8 percent increase in mutton prices between January and February alone.

An unhappy new year

“Traditionally, during this time of the year, half of my shop's inventory would be sold,” Faramarz, a suit salesman in the bustling bazaar, told MEE.

“We usually offer a generous sale before Nowruz (Persian New Year, which is on 21 March this year), but even with marked-down prices, there has been an unexpected dearth of shoppers. Unfortunately, the exorbitant prices have rendered many items unattainable for some of our customers.”

Mohammad Hossein, the owner of a dried fruit store, told MEE: “We are only selling small quantities of 200 or 300 grams now. Gone are the days of selling kilos of nuts.

"Customers say it's not worth it anymore, and many have decided to forego purchasing nuts altogether for new year, though nuts are an important part of people’s purchases for their parties.”

Many vendors said they weren’t happy about charging elevated prices, saying this was contributing to poor sales.

As Mohsen's vibrant collection of children’s clothes caught the eye of a woman and her six-year-old son, their gaze lingered longingly.

“I understand destitution and having empty pockets, but how do I convey to my innocent child the true meaning of 'we don't have'? Our meagre income no longer suffices to meet our bare necessities, let alone the extravagant expenditure of Nowruz shopping,” the woman told MEE, as she decided not to buy the clothes.

Will the economy improve?

“The rial has weakened significantly against the dollar and it seems there will be another huge jump in the next year,” an economist, who spoke to MEE on condition of anonymity owing to security reasons, said.

“The issue is very simple: in order to maintain the value of their money due to next year's inflation, people will convert their rial capital into dollars or other currencies, and the exchange rate will increase due to inflationary expectations.

"The increase in the exchange rate will also lead to a general increase in the price of goods and services,” the economist told MEE.

“Therefore, it is estimated that at the beginning of next year, the exchange rate will probably resume its upward path.

"The government insists a lot on how it has curbed inflation, but what has been observed so far is that not only has no policy been implemented in this regard, but we are witnessing an increasing surge in the rate of inflation in the country due to economic policies,” they said.

In an interview with MEE, a former member of Iran's Chamber of Commerce, who spoke on condition of anonymity, discussed the problems of the nation's economy, arguing that the solution to the dire economic woes plaguing the country is the removal of US sanctions, as well as the appointment of proficient people to helm both the presidency and the finance ministry.

Moreover, he said that the nation's economy would remain stagnant unless it is integrated into the global financial system.

He added that the recently announced detente with Saudi Arabia would not hold significant economic benefits, as the nation's economic ties with the country are relatively meagre.

The economist told MEE that the financial situation in Iran would continue to degrade and that this would lead to an increase in food prices, inflation rates and more.

The former Chamber of Commerce member said that “the revival of the 2015 nuclear deal and the subsequent termination of sanctions would alleviate some of the economic strain.

"We should normalise our ties with the US, we have no other way. Because the sword of Damocles of US sanctions will always be there, and this stops investors coming to Iran. Therefore, for the sake of our economy, the Islamic Republic must forget all about its ideology and shake hands with the US.”

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.