Iran's currency crisis: Now it's two gold coins to rent an apartment

TEHRAN - It’s the commodity which becomes a safe haven at times of economic crisis. Now, with the crash of the rial, Iranians are using gold for more everyday payments, most notably rent – but the resulting price hikes are starting to affect the demographics of Tehran itself.

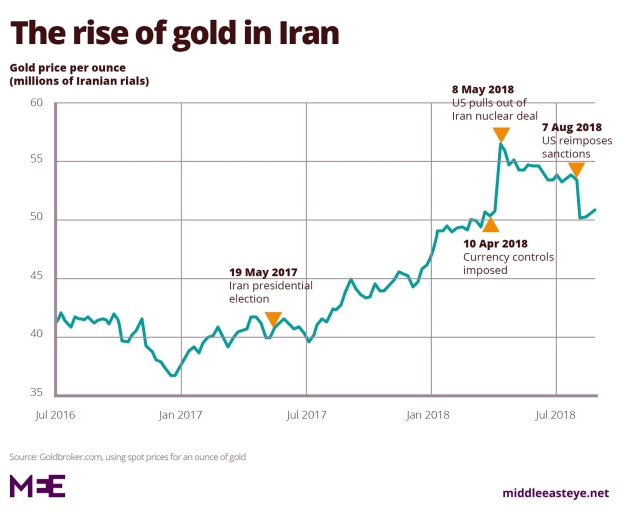

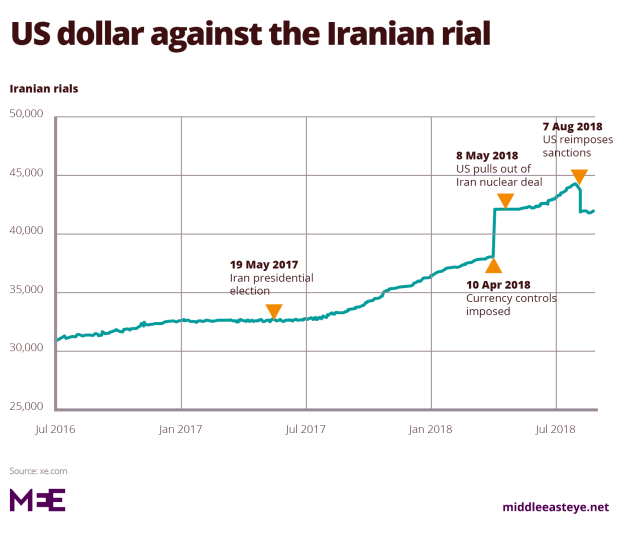

The currency began to slump in December, when Washington flagged that it would withdraw from the 2015 nuclear deal.

That decline accelerated in May after US President Donald Trump made a formal announcement that the US was pulling out of the deal with world powers and reimposing economic sanctions on Iran.

While the offical rate peaked at around 45,000 rials to the dollar, this was only available for a small group of importers and businesses, leaving most Iranians to pay double that.

On 29 July, in the runup to fresh US sanctions, money exchanges in Tehran were charging around 100,000 rials for one dollar; within 24 hours this had increased to 110,000 rials.

Iranians have traditionally saved gold coins for major purchases such as wedding costs. That behaviour has become more common, however, with the re-imposition of US sanctions in August, when gold purchases hit a four-year high.

Meanwhile one gold coin neared 40m rials, although that rate has since decreased to 36m rials.

Rents go up as purchasing power falls

The downward spiral of the rial has led some landlords to try to safeguard their income by turning to gold.

Hesam Oqabai, the chairman of the Real Estate Agents Union of Tehran province, said the housing market accounts for about 45 percent of activity in the Iranian economy.

“Given our country's economic condition, the fluctuations in the foreign exchange market are affecting the housing market," he said.The result has been a doubling of rents in some Tehran neighbourhoods, including Dibaji Jonubi, Shahrake Qarb, Mirdamad and Ferdows Qarb.

According to a report by the country’s central bank, housing costs accounted for more than 35 percent of household income during the past year.

But that doesn't reflect what has happened during the past few months, with rents continuing to rise, but the government unable to to counter this by increasing wages or keeping a check on inflation.

Result: families in Tehran have had to reduce their spending on other items to compensate for the rent rises or else look for cheaper places to live, including outside the capital.Oqabai said: "Unfortunately, in the past few months, we have witnessed massive fluctuations in foreign exchange and gold markets. This has created a kind of psychological negative viewpoint among people.

"Housing prices have risen by 50 percent, but dollar and gold prices have risen by more than 150 percent."

Why landlords turn to gold

Esamil Jalali is a landlord in Vanak, a wealthy and well-connected bustling neighbourhood in northern Tehran.

He is one of those property owners who not only has increased his rents but also asked for payment in gold rather than in rials.

"I know that many may not be able to afford it,” he said, “but when I see that the currency I may get from my tenants would have less value compared to the previous month, then that leaves me with no choice. If I continue to rent out my apartment in return for rials, then I would face financial loss."

Some landlords are also known to be demanding payment in dollars from their tenants, although such widespread behaviour, while not illegal, is frowned on by the authorities.

Renting out houses in return for gold coins is a catastrophe. It may lead to the continuation of the current situation and gold prices fluctuations

- Albert Boghzian, economist

Estate agents report that the number of rental contracts are now declining as many would-be tenants cannot afford to pay.

Mohsen Shemirani, a real estate agent, told Middle East Eye: "We are asking the owners to reduce their rents rate by for example 20 or 30 percent, but they refuse."

Many experts say that the current rental crisis was predictable once the rial crashed and people flocked to the foreign exchange and commodities markets to turn their assets into dollars or gold.

Albert Boghzian, an economist and a professor at the University of Tehran, said he feared that further economic pressure, such as rent hikes, would ultimately lead to fraud.

"Renting out houses in return for gold coins is a catastrophe. It may lead to the continuation of the current situation and gold prices fluctuations."

The flight to the suburbs

The rise in rents may also have longer term consequences if it begins to reshape the demographics of Tehran and the region.

Residents who previously could meet the expense of living in north Tehran are moving to cheaper houses in poorer areas.

But that in turn is forcing tenants who live there to leave the capital.

The destinations for those leaving, according to anecdotal evidence from estate agents, are mostly suburban cities surrounding Tehran, such as Andishe, Shahriar, Rudehen and, further away, Paradis, where new arrivals will have stronger purchasing power. Most are ordinary workers.

Hamid Jamshidi, a thirtysomething taxi driver working in Tehran, told MEE how he left the capital three months ago for Andishe, where he rents an apartment he uses just for sleeping, because he didn’t have enough money to rent.

I currently live in Andishe, but I don't like the atmosphere and culture, as I belong to Tehran and its culture

- Hamid Jamshidi, taxi driver

“I have a bachelor degree in accounting but I haven't been able to find a job,” he said, adding that he had also thought about leaving Iran altogether.

“I currently live in Andishe, but I don't like the atmosphere and culture, as I belong to Tehran and its culture. The only positive thing about there is that it is not polluted.”

Oqabai said that the emigration of tenants to suburb cities could lead to social problems, including putting extra strain on infrastructure and services.

"The emigrants mostly work in Tehran. Now they will pay extra money for commuting to Tehran."

The side benefits?

But others believe that the shift in population may bring with it longer-term advantages.

Amanollah Qara'i Moqaddam, a sociologist and a professor at Shahid Beheshti University, said that a decrease in Tehran’s population could reduce overcrowding and ease traffic congestion.

The suburbs, he said, were less cosmopolitan compared to the capital but could now be transformed with the arrival of more educated people from metropolitan cities like Tehran.

"It can also mean that the local people in the suburbs will recognise and get to learn about their citizenship rights and other things."

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].