$19.5bn Israeli gas deal with Spanish company scrapped

A $19.5bn agreement that would have seen Israeli gas supplied to a Spanish company for 15 years has been scrapped, according to public filings on the Tel Aviv Stock Exchange.

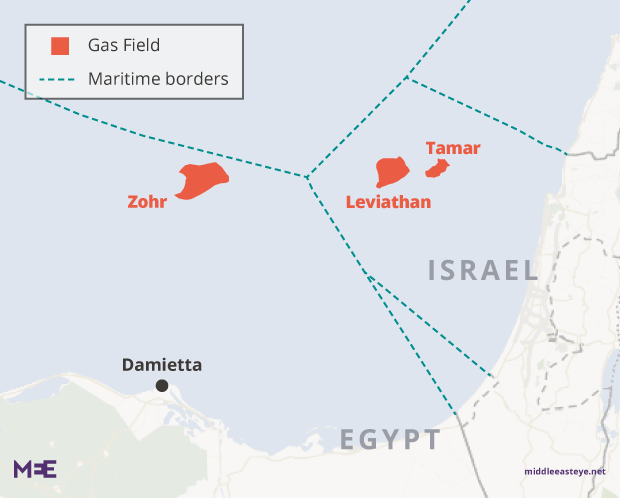

According to a non-binding letter of intent signed in May 2014, partners in Israel’s Tamar field would have supplied gas to Madrid-based Union Fenosa Gas (UFG).

The gas was to be liquefied at an Egyptian plant in Damietta which is operated by Segas, a joint venture between UFG and Italian energy giant Eni, and two state-owned Egyptian companies, and then sent to Spain.

But the agreement is "no longer relevant," according to records which Delek Drilling, one of Tamar's partners, filed this week.

The cancellation, said analysts, suggests that Egypt, which has started producing gas in December from the Zohr "supergiant" field which Eni found in 2015, may supply the gas instead.News of the cancellaton comes just weeks after the announcement that Israel's Delek Drilling and Texas-based Noble Energy have agreed to supply $15bn worth of natural gas from Tamar and a second field, Leviathan, to private Egyptian firm Dolphinus over the next decade.

Egypt was once a net exporter of gas, but years of political instability and mismanagement, including deals which MEE has investigated, led to it importing gas for its rising population.

Recently, Egypt has been putting out signals that it plans to become an exporter again in the coming years.

When the Noble/Delek-Dolphinus deal was announced, Egyptian President Abdel Fattah al-Sisi said the country had "scored a goal" and the deal would "help transform Egypt into a regional energy hub".

Many Egyptians, however, criticised the deal and questioned why the country was importing more gas months after gas started to be produced from Zohr.

Many questions remain over the deal, including how the gas would be transported and at what price.

David Butter, an associate fellow at Chatham House, said in light of recent developments, the end of the Union Fenosa-Tamar deal "seems logical".

"Either because it would be superseded by the Dolphinus deal, which is half and half Tamar and Leviathan, or because Segas reckons it will be able to push some Zohr or other Eni-produced gas through Damietta," he said.

Amnon Portugaly, a researcher with the Chazan Centre at the Van Leer Jerusalem Institute, said the gas from Zohr has put Union Fenosa in a stronger bargaining position.

"They can take the gas from Zohr, send it to Damietta, and send it to Spain, and everyone is happy – except Israel, which has to cancel the contract," Portugaly said.

Union Fenosa, Eni, Delek and Texas-based Noble Energy, the largest shareholder in Tamar, did not respond to MEE's requests for comment.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.