Qatar to invest $15b in Turkey's financial markets and banks

Qatar pledged $15 billion of investment in Turkey that will be channeled into Turkish financial markets and banks, a government source told Reuters on Wednesday.

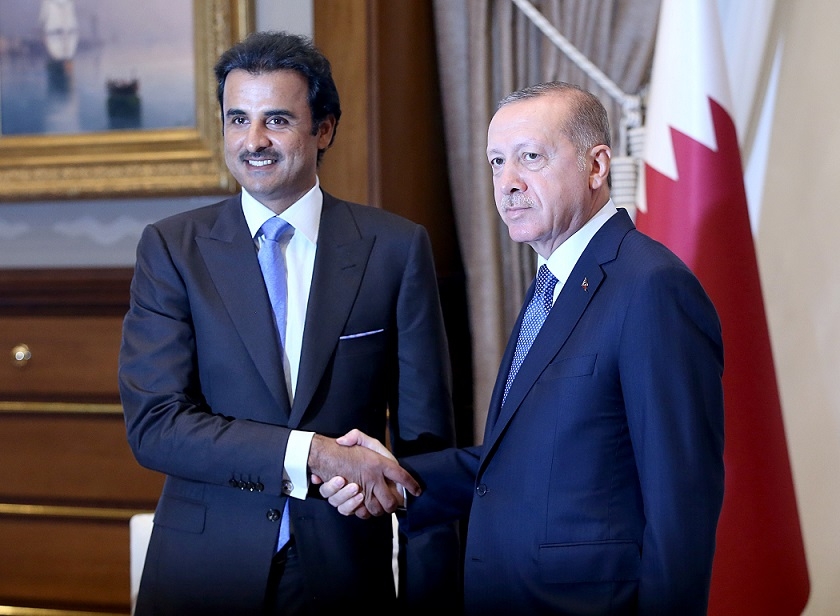

The investment package was announced after Qatar's Emir Tamim bin Hamad Al Thani met President Tayyip Erdogan in Ankara, as Turkey grapples with a collapse in the lira and tensions with NATO ally the United States.

Ibrahim Kalin, the special advisor and spokesperson of Erdogan, tweeted that 'Turkish-Qatari relations are based on solid foundations of true friendship and solidarity.'

Turkey has been thrown into crisis mode over the past week after US President Donald Trump doubled steel and aluminium tariffs on the country, sending the value of the lira into free-fall.

After reaching record lows on Monday, the lira rebounded to stronger than 6.0 against the dollar on Wednesday.

Turkey and Qatar have traditionally maintained good ties and Ankara stood by Doha after Saudi Arabia and other Arab states severed diplomatic, trade and travel ties with Qatar last year, accusing it of financing terrorism, a charge Doha denies.

Turkey, which has a military base in Qatar, rushed through supplies to the Gulf state after Saudi Arabia, the United Arab Emirates, Bahrain and Egypt imposed the boycott. Qatar is allied with the West.

Qatar's banking sector has considerable exposure to Turkey, whose currency has lost nearly 40 percent this year.

Qatar National Bank, the Middle East and North Africa's largest bank, in 2016 completed the acquisition of Turkey's Finansbank. Now around 15 percent of QNB's assets and 14 percent of its loans relate to Turkey, according to Arqaam Capital.

Commercial Bank, Qatar's third-largest bank by assets, has been deploying more capital and focus on its Turkey business in a bid to benefit from closer political ties between the two countries. The lender owns Turkey's Alternatifbank

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.