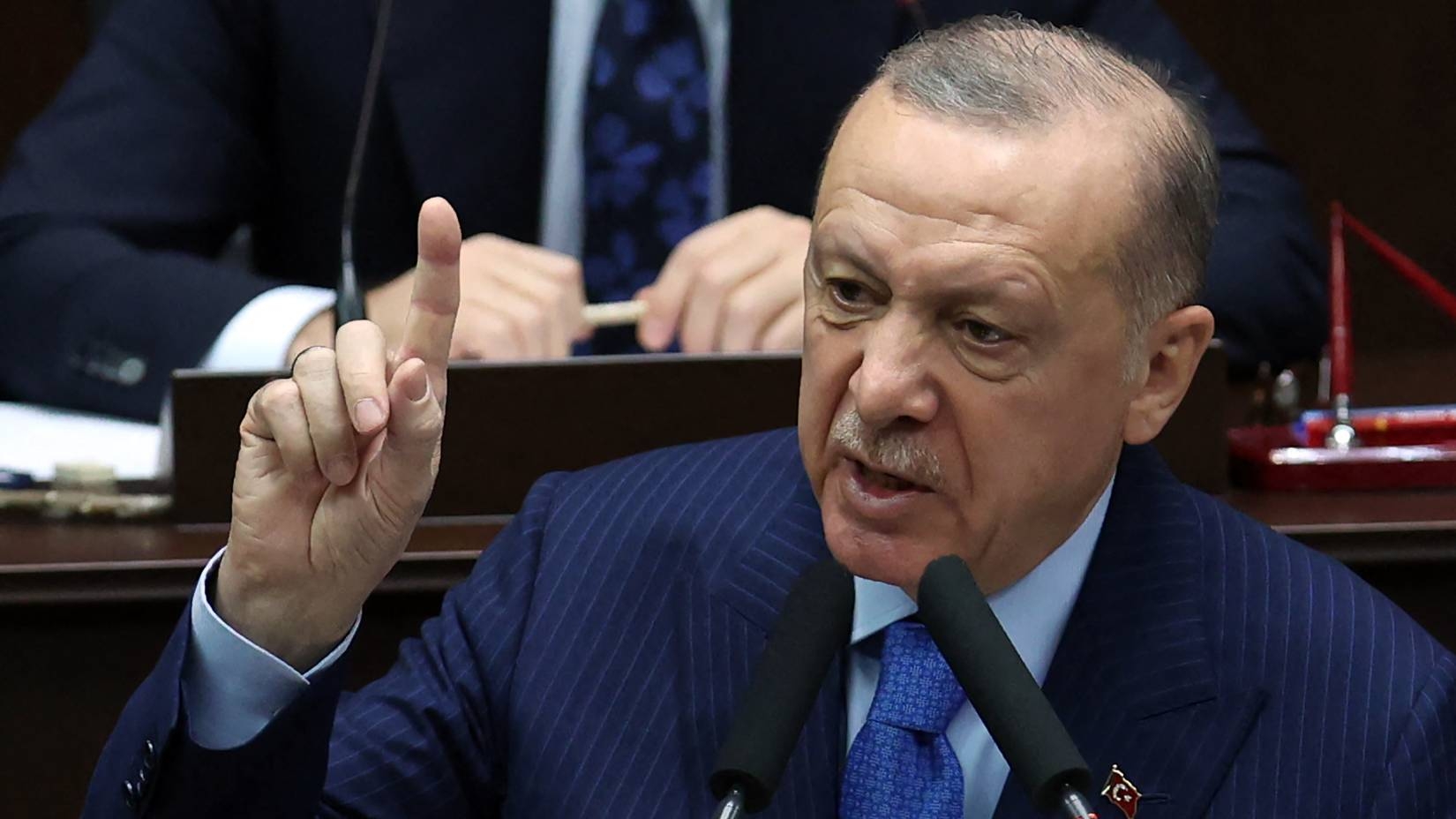

Erdogan asks Turks to keep their savings in lira

Turkish President Recep Tayyip Erdogan said on Friday that people should keep all their savings in lira, rather than in foreign currencies, and that recent exchange rate volatility was largely under control after the lira sharply depreciated in the past two months.

"I want all my citizens to keep their savings in our own money, to run all their business with our own money, and I recommend this," Erdogan said in a speech in Istanbul.

"Let's not forget this: as long as we don't take our own money as a benchmark, we are doomed to sink. The Turkish lira, our money, that is what we will go forward with. Not with this foreign currency, that foreign currency."

Addressing a business group, Erdogan also called on the Turkish population to bring their gold savings into the banking system and reiterated his unorthodox view that interest rates were the cause of inflation.

"For some time, we have been waging the battle of saving the Turkish economy from the cycle of high interest rates and high inflation, and taking it on the path of growth through investment, employment, production, exports and current account surplus," the president said.

"Interest rates down, interest rates up. My friends, let us please take this out of our books. Interest rates make the rich richer and the poor poorer."

Earnings in Turkey have eroded in recent months due to a crash in the lira. The currency rebounded from an all-time low of 18.4 versus the dollar last week after the introduction of a state scheme to protect local deposits from depreciation losses versus hard currencies.

Still, the lira is down more than 40 percent this year and is by far the worst performer in emerging markets in 2021.

Soaring prices

The lira crisis was triggered by the central bank's aggressive interest rate cuts. Since August, the bank has cut its policy rate by 500 basis points, from 19 percent to 14 percent. Meanwhile, exports jumped 33 percent in November, reaching $21.5bn, while the current account posted a $3.16bn surplus for October.

Unemployment has also decreased by about two percentage points, from 13.1 percent to 11.2 percent in October year-on-year. GDP grew by seven percent in the third quarter of 2021.

However, the government's economic policy continues to be very unpopular with investors as inflation rises, with expectations that this may hit 26 percent annually this year. Goldman Sachs said it expects inflation to reach as high as 40 percent by mid-2022.

Erdogan's economic policy has sent real yields deeply negative and amounted to a red flag for foreign investors who have fled Turkey in recent years.

The premium demanded to hold Turkish hard currency sovereign bonds over safe-haven US Treasuries soared by 136 basis points throughout 2021, based on the JPMorgan EMBI global diversified index.

The cost of insuring exposure to Turkish debt based on five-year credit default swaps nearly doubled over the year to 566 basis points from 305, data from IHS Markit showed.

To ease the economic turmoil of the weakened currency, the president unveiled a scheme last week in which the state protects converted local deposits from losses versus hard currencies, sparking a 50 percent rally in the lira with the support of the central bank.

Under the new deposit scheme, intended to reverse the tide of dollarisation, the state covers the difference between deposit rates and the foreign exchange and gold rate for lira converted into the new instrument.

Finance Minister Nureddin Nebati said this week the population's dollar holdings had fallen, but official data on Thursday showed local holdings, including companies, of hard currencies soared to a record $238.97bn last week.

At the same time, the central bank's net foreign currency holdings - its effective buffer against financial crisis - plunged to a near two-decade low of $8.63bn.

Experts have also warned that the lira's depreciation puts a huge burden on the average Turkish citizen, who is now struggling to make ends meet amid soaring prices.

Bread prices have shot up by 25 percent in the past month alone, creating long lines of people outside subsidised bakeries owned by local municipalities.

Flour prices have jumped by 300 percent in a year, while other basic items such as milk and cheese have seen a 47 percent price rise due to increasing costs.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.