Dubai, the business capital of Africa

For hundreds of years, the business capitals of Africa were in Europe - in London, Paris, Berlin and Lisbon.

Despite decolonisation, money still flows from Africa to European financial hubs, but over the past decade business headquarters have geographically shifted. Not back to Africa, but to another former British colony: Dubai.

There are now more than 21,000 African companies in Dubai, which is part of the United Arab Emirates (UAE). It's a number that has increased by over a quarter since 2017, according to Dubai Chamber of Commerce and Industry figures.

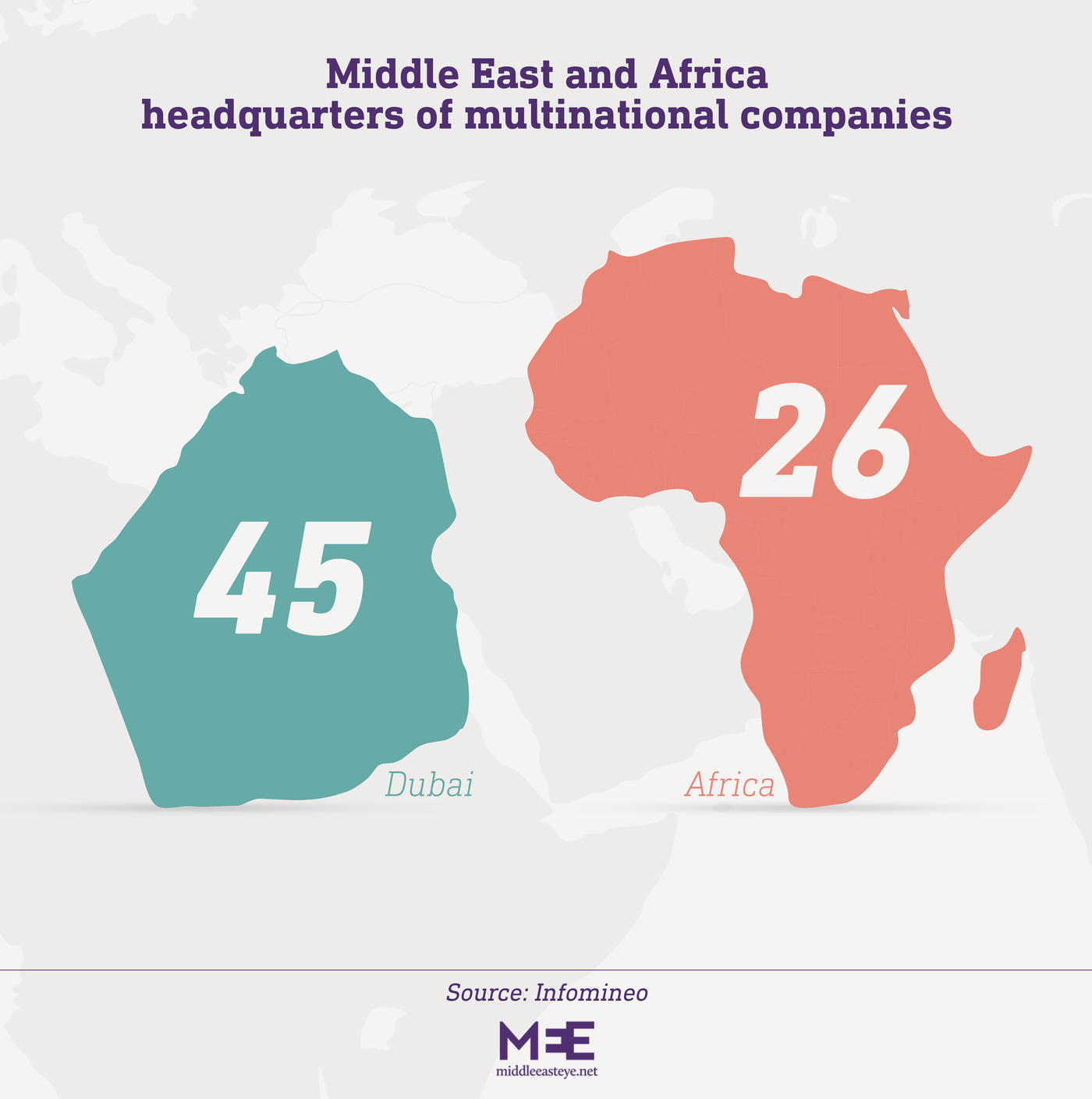

The emirate has also attracted 45 Middle East and Africa headquarters of multinational companies - compared to just 26 in Africa, according to a 2018 report by Infomineo, a data and research outsourcing provider specialising in Africa and the Middle East.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

The amount of capital and number of businesses dealing with Africa started to rise around the same time as the Arab Spring uprisings a decade ago.

“There were big inflows of Africans to Dubai from 2011 onwards. The Arab Spring actually helped open Dubai and the UAE to greater interest from African countries,” Theodore Karasik, a senior adviser to Gulf State Analytics, a Washington-based consultancy, told MEE.

The number of tourists from Africa has increased from just 6,954 in 1984 to 600,000 in 2016, reaching 810,000 in 2019, equivalent to 6% of all visitors, according to Dubai Tourism figures.

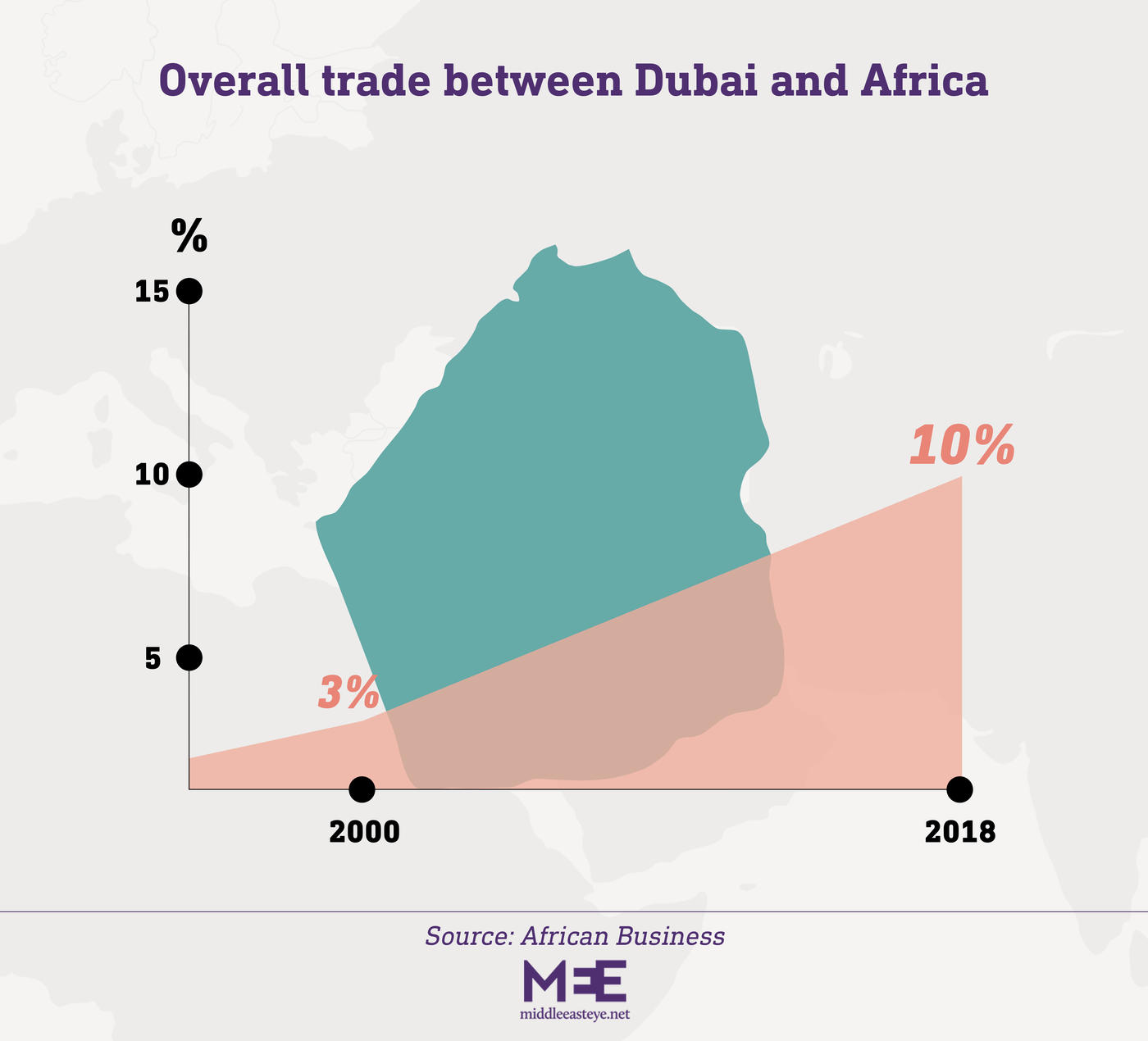

Overall trade with Africa also surged, from 3% of Dubai’s total trade at the turn of the century to 10% in 2018.

The African continent has become the third-largest trade region for Dubai after Asia and Europe, according to Dubai Customs.

“Years ago it was the Russians coming in, then the Chinese, and as that tapered off we were seeing Africans, with an explosion of wealth in this direction,” Scott Cairns, managing director of Creation Business Consultants in Dubai, told MEE. “It has slowed a little bit [over the past year, due to the Covid-19 pandemic] but once travel is allowed again we will see Africa re-emerge, as it is so close for building up business, and to commute [from Dubai] for projects.”

A ‘counterintuitive’ boom

The Gulf city, which sits on the other side of the Arabian Peninsula from Africa, did not intentionally become a hub for African business.

“It was not the Dubai government, but people in power in Africa that chose to do business in Dubai,” Martin Tronquit, managing partner at Infomineo, told MEE.

But capitalising on its geographical position, the Gulf city has transformed into the business hub of the Middle East and Africa (MEA) through laissez-faire policies, infrastructure and aviation networks.

The boom in MEA firms setting up shop in Dubai has contributed, in part, to the emirate successfully weaning itself off reliance on oil revenues. Non-oil trade with Africa has grown by 700 percent over the past 15 years, surging from $33bn in 2015 to $50bn in 2019, according to the Dubai Chamber of Commerce and Industry.

While six regional HQs are in the energy sector, eight are involved in financial services, seven in motor vehicles and parts, and five in technology, followed by wholesalers, aerospace and defence companies, healthcare, and transportation, according to Infomineo.

“When we looked at where Fortune 500 decision-makers were based, almost half of total headquarters covering MEA were in Dubai, more than triple the number of Johannesburg [South Africa], which was ranked second, followed by Nairobi [Kenya], Casablanca [Morocco] and Lagos [Nigeria],” said Tronquit, citing data from Infomineo.

“It did feel counterintuitive as Dubai is not technically located in Africa.”

Dubai’s aviation links, tourism infrastructure and ease of access have also been a big driver in making the emirate such a hub for African business, said Cairns.

For a lot of them, said Isaac Kwaku Fokuo Jr, founder of Botho Emerging Markets Group, an investment advisory firm based in Dubai, “it is easier to go from Dubai to Africa than fly within Africa. And the ability to let people travel here freely is a big deal, compared to say London or New York, where there are multiple unnecessary barriers like the provision of bank statements to procure a visa just to attend a business meeting.

“Also, within the African continent, some countries such as South Africa, another business hub, have strict visa regulations,” he told MEE. “That means that visiting can be an onerous experience. In contrast, the hospitality on display in Dubai signals that Africans from across the continent are welcome.”

Capital by default?

Dubai has been helped, said Tronquit of Infomineo, by the fact that while “African business environments have massively improved in the last 20 years, [they] are not yet on par with the expectations of global companies - especially when it comes to international trade, like double taxation agreements, work visas for expats, corporate laws and tariffs.”

Lagos should logically be Africa’s business capital, he added. Nigeria has the continent’s largest economy. South Africa’s is second. However, “Lagos has been ranked as one of the world’s worst cities to live in, and personal safety is a massive issue, as it is in Johannesburg.

“It is also difficult to attract top executives and their families to countries where, for most of them, education, healthcare and safety are not up to global standards,” said Tronquit, based on criteria in an Infomineo report.

'It did feel counterintuitive as Dubai is not technically located in Africa'

- Martin Tronquit, Infomineo

“Dubai is the business capital of Africa by default.”

While “Dubai locals have considered the emirate the business capital of Africa for over a decade,” said Karasik of Gulf State Analytics, to Africans the moniker does not always sit well.

“Dubai is a hub that plays a critical role for business into Africa, but it would be unfair to say that it is the business capital for an entire continent,” said Fokuo. “Cities such as Nairobi, Johannesburg, Cairo and Accra also play critical roles as hubs for business.”

He moved to Dubai from Nairobi four years ago, and has since seen an upswing in business, partnering with firms in Saudi Arabia, Kuwait, Bahrain and Egypt to help them expand into Africa. “I jokingly say there are now more African companies trying to work with us in Dubai than when we had a presence only in Kenya.”

A two-way street

Africa-UAE trade and business is set to increase as the Emirates look to expand ties with emerging markets. The UAE is the second-largest country investor in Africa after China, according to UNCTAD, investing $25.3bn between 2014 and 2018, while the Abu Dhabi Fund for Development, the emirate’s foreign aid agency, has been the biggest investor, at $16.6bn, in 28 African countries, according to the Financial Times’ fDI Intelligence.

Other countries in the region are also eyeing up the opportunities. “Africa is a central focus of the Gulf states due to Covid-19 and the need for economic recovery, with a focus on mining and green energy projects,” said Karasik. “They are competing on the continent.”

Israelis, too, are seeking business in Africa through Dubai, with consultancy firms in the emirate noting an uptick in contact from Israel since the recently signed Abraham Accords, normalisation deals between Israel and several Arab states.

This renewed interest in Africa is being bolstered by the African Continental Free Trade Area (AfCFTA), which came into effect in January. It brings together 1.3 billion people in a $3.4tn economic bloc of 54 African countries.

The UAE has been a strong proponent of the scheme.

“As African markets are very fragmented, consolidated projects [like the AfCFTA] make it easier to engage. Dubai is identifying opportunities,” said Fokuo.

Downsides

One disadvantage of being located in Dubai, however, is that firms are far-removed from their target markets.

“There are lots of ‘Africa’ HQs in Dubai, but that doesn’t allow you to get a sense of what is happening on the ground, as you’re not in Nairobi or Ghana,” said Fokuo.

With this in mind, the Dubai Chamber of Commerce & Industry has established four international offices in Africa over the past seven years – in Ethiopia, Ghana, Mozambique and Kenya.

“It would also be great if more Dubai-Africa events took place in Africa instead of in Dubai," added Fuoko.

Another concern is that Dubai’s growing role as a tax haven is hurting African nations. According to UK-based advocacy group the Tax Justice Network, “Dubai is unquestionably one of the world’s best-known secrecy jurisdictions, built on an increasingly complex array of offshore facilities that include free-trade zones, a low-tax environment, multiple secrecy facilities and lax enforcement.” Such policies enable the illicit flows of capital out of Africa to Dubai.

'I jokingly say there are now more African companies trying to work with us in Dubai than when we had a presence only in Kenya'

- Isaac Kwaku Fokuo Jr, Botho Emerging Markets Group

Lakshmi Kumar, Policy Director at Global Financial Integrity in Washington DC, told MEE: “The African continent is losing valuable revenues it needs through companies avoiding paying taxable income. It is definitely a problem.”

Kumar noted that Dubai plays a key role as a tax haven, with the Dubai International Financial Centre having the largest cluster of financial institutions anywhere in the Middle East, Africa and South Asia.

Dubai has also been criticised for its role in the illicit gold trade, with “blood gold” smuggled from Africa to the emirate.

Analysts said that Dubai has become an increasingly important hub over the past year for gold exports from Africa, while the Emirate’s low taxation rate continues to make it attractive to set up businesses, for African as well as European firms avoiding higher tax rates.

The city’s property market has also been fingered as an ideal outlet for ill-gotten gains, such as for Nigeria’s elite.

“Dubai is a key centre for almost every crime, which makes it a bit unique,” said Kumar.

This article is available in French on Middle East Eye French edition.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.